Summit Therapeutics Closes Deal with Akeso Inc. to In-License Breakthrough Innovative Bispecific Antibody

23 January 2023 | Monday | News

Image Source : Public Domain

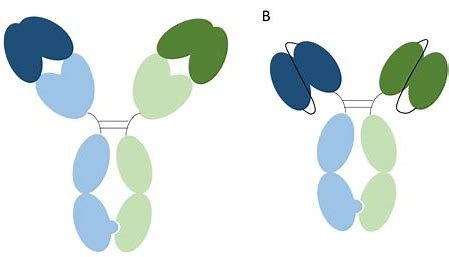

Summit Therapeutics Inc. (NASDAQ: SMMT) (“Summit,” “we,” or the “Company”) today announced that we have completed the closing of our previously announced definitive agreement with Akeso Inc. (HKEX Code: 9926.HK, “Akeso”) to in-license its breakthrough bispecific antibody, ivonescimab. Ivonescimab, known as AK112 in China and Australia, and as SMT112 in the United States, Canada, Europe, and Japan, is a novel, potential first-in-class bispecific antibody combining the effects of immunotherapy via a blockade of PD-1 with the anti-angiogenesis effects associated with blocking VEGF into a single molecule.

Summit is initiating development activities for SMT112 and will do so first in non-small cell lung cancer (NSCLC) indications.

The definitive partnership calls for Summit to receive the rights to develop and commercialize ivonescimab (SMT112) in the United States, Canada, Europe, and Japan. Akeso will retain development and commercialization rights for the rest of the world, including China.

In exchange for these rights, Summit committed to an upfront payment of $500 million to be paid in two installments. The first installment worth $300 million has been paid in conjunction with the closing of the transaction. Of the $300 million paid to Akeso by Summit, Akeso opted, in accordance with the definitive agreement, to convert approximately $25.1 million of the payment into 10 million shares of Summit common stock; the remaining $274.9 million was paid by Summit to Akeso in cash. The second installment of $200 million will become due on March 5, 2023 and will be paid by Summit in cash.

Going forward, Akeso will be eligible to receive regulatory and commercial milestones of up to an additional $4.5 billion. In addition, Akeso will receive low double-digit royalties on net sales in the Summit territories.

In conjunction with the closing of the deal, Dr. Michelle Xia, Co-Founder, Chairwoman, and CEO of Akeso, has been appointed to the board of directors of Summit.

Update on $500 Million Rights Offering

We continue to plan for our previously announced rights offering, which will be available to all holders of record of the Company’s common stock, par value $0.01 (the “Common Stock”) as of the close of the market on the record date. The record date will be no earlier than February 2, 2023 (the “Record Date”).

The Company intends to distribute to all holders of Common Stock as of the Record Date non-transferable subscription rights to purchase shares of Common Stock at a price per share equal to the lesser of (i) $1.05, or (ii) the volume weighted-average price of the Common Stock for the five consecutive trading days through and including the expiration date of the offering. Assuming that the rights offering is fully subscribed, the Company will receive gross proceeds of up to $500 million, less expenses related to the rights offering.

We will provide additional information as we approach the final record date.

Summit has filed a registration statement (including a prospectus) on Form S-3 with the Securities and Exchange Commission (the “SEC”) on December 21, 2022, which has not yet become effective. The registration statement covers, among other things, the rights offering to which this communication relates. Such securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. Before you invest, you should read the final prospectus in that registration statement, together with any prospectus supplement, that we will file prior to commencing any rights offering, and the documents incorporated by reference in the prospectus (or any prospectus supplement), as well as the other documents Summit has filed with the SEC for more complete information about Summit and the rights offering. You may get these documents for free by visiting EDGAR on the SEC’s website at www.sec.gov.

This press release does not constitute an offer to sell or the solicitation of an offer to buy these securities, nor will there be any sale of these securities in any state or other jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. The rights offering will be made pursuant to an effective registration statement on Form S-3 containing the detailed terms of the rights offering to be filed with the SEC. Any offer will be made only by means of a prospectus forming part of the registration statement.

Most Read

- How Does GLP-1 Work?

- Innovations In Magnetic Resonance Imaging Introduced By United Imaging

- Management of Relapsed/Refractory Multiple Myeloma

- 2025 Drug Approvals, Decoded: What Every Biopharma Leader Needs to Know

- BioPharma Manufacturing Resilience: Lessons From Capacity Expansion and Supply Chain Resets from 2025

- APAC Biopharma Review 2025: Innovation, Investment, and Influence on the Global Stage

- Top 25 Biotech Innovations Redefining Health And Planet In 2025

- The New AI Gold Rush: Western Pharma’s Billion-Dollar Bet on Chinese Biotech

- Single-Use Systems Are Rewiring Biopharma Manufacturing

- The State of Biotech and Life Science Jobs in Asia Pacific – 2025

- Asia-Pacific Leads the Charge: Latest Global BioSupplier Technologies of 2025

- Invisible Threats, Visible Risks: How the Nitrosamine Crisis Reshaped Asia’s Pharmaceutical Quality Landscape

Bio Jobs

- Sanofi Turns The Page As Belén Garijo Steps In And Paul Hudson Steps Out

- Global Survey Reveals Nearly 40% of Employees Facing Fertility Challenges Consider Leaving Their Jobs

- BioMed X and AbbVie Begin Global Search for Bold Neuroscience Talent To Decode the Biology of Anhedonia

- Thermo Fisher Expands Bengaluru R&D Centre to Advance Antibody Innovation and Strengthen India’s Life Sciences Ecosystem

- Accord Plasma (Intas Group) Acquires Prothya Biosolutions to Expand Global Plasma Capabilities

- ACG Announces $200 Million Investment to Establish First U.S. Capsule Manufacturing Facility in Atlanta

- AstraZeneca Invests $4.5 Billion to Build Advanced Manufacturing Facility in Virginia, Expanding U.S. Medicine Production

News